The Trump administration committed to supporting the oil and gas sector, partly through reducing backing for renewable energy and programs aimed at decreasing emissions. However, numerous business leaders and experts argue that the shift towards more sustainable sources of power will persist. Despite this, they anticipate that uncertainties in legislation and shifts in policies might hinder this transformation process.

Here’s what you should understand regarding how the choices made by the Trump administration might impact the sector:

1. It is anticipated that tariffs will increase the expenses for projects.

President Trump’s

sweeping tariffs

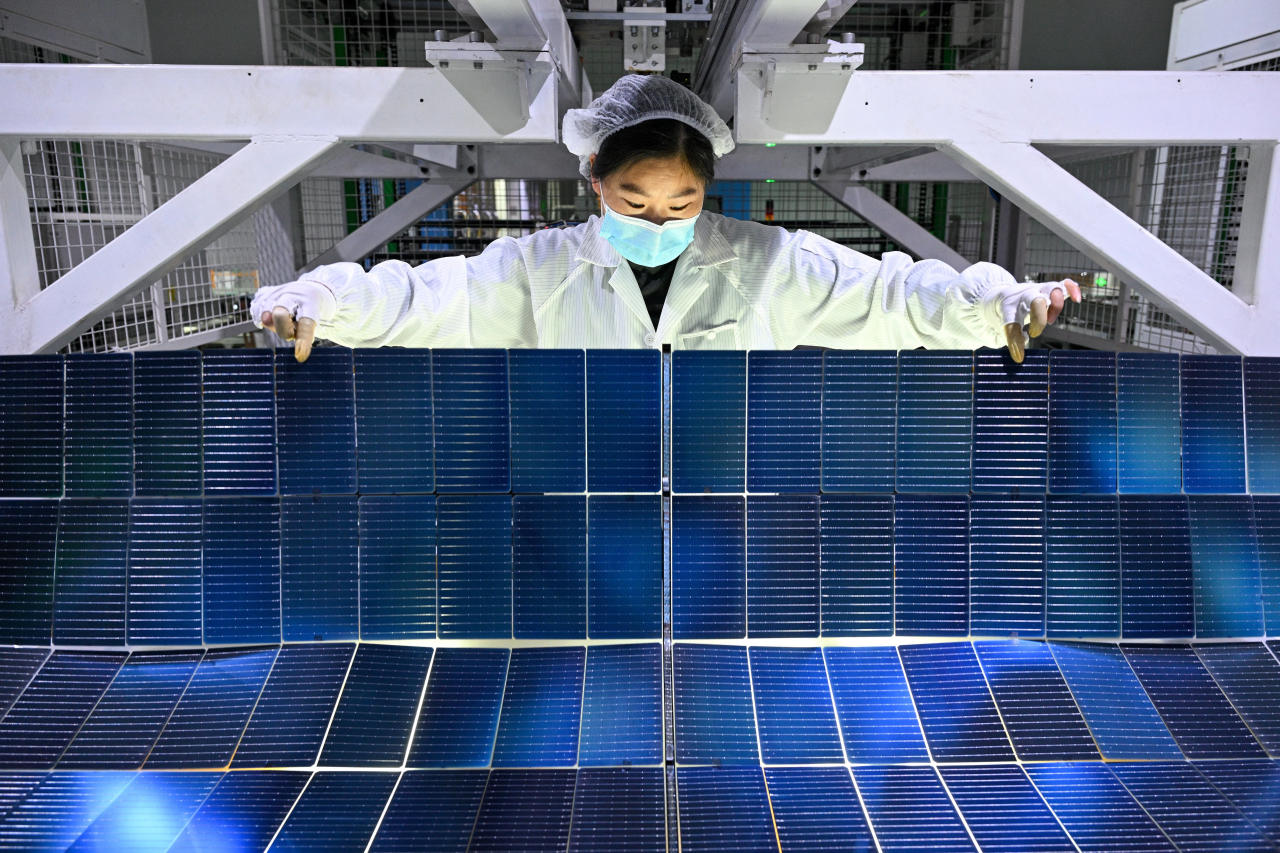

Are anticipated to impact nearly all materials required for constructing wind and solar farms, battery storage systems, electric vehicles, and other initiatives aimed at decreasing carbon emissions. Tariffs imposed on imported steel, aluminum, solar panels, and minerals will lead to higher expenses in both construction and development processes.

“It’s too early to provide an evaluation of this policy, but clearly there is significant worry, not only within our sector but throughout the entire U.S. economy,” states Frank Macchiarola, who serves as the chief advocacy officer for the American Clean Power Association trade group.

The U.S. heavily depends on Asian countries for manufacturing solar modules, which are essential components of both extensive solar facilities and residential photovoltaic setups. Analysts from Jefferies, an investment firm, report that around 55 gigawatts of these solar modules were brought into the U.S. in the previous year. While current panel reserves within the country appear robust, experts anticipate potential setbacks such as delayed projects and rising costs once developers start utilizing these stored supplies.

2. Certain parts of the Inflation Reduction Act are facing potential threats.

The Inflation Reduction Act, which stands as President Biden’s key piece of environmental legislation, includes various tax incentives for clean energy. Former President Trump has discussed revoking this act; however, business leaders and experts anticipate he might adopt a more strategic method to dismantle certain aspects of it rather than eliminating the entire policy.

“Due to President Trump’s efforts, America is at the forefront of reducing expenses by eliminating bureaucratic hurdles and making available, ample, and dependable American energy sources,” states a representative from the Department of Energy.

The Inflation Reduction Act encompasses tax incentives for wind, solar, and battery ventures, along with electric cars, clean fuel creation, and energy-efficient programs. These incentives have catalyzed over $100 billion in manufacturing expenditures, benefiting numerous Republican-leaning regions.

Last month, 21 Republican members of the House signed an open letter endorsing the preservation of tax credits. They argued that these credits have contributed to boosting domestic manufacturing and maintaining lower utility expenses.

“Both our constituents and the energy sector continue to be worried about significant alterations to our country’s taxation policies for energy,” they stated.

3. Development of wind, solar and battery storage may slow

Electricity consumption in the U.S. is anticipated to rise sharply following years of relatively stable levels. According to a report released last month by S&P Global Commodity Insights, this trend is set to change.

The demand is expected to go up.

By 35% to 50% by 2040 due to expansion in domestic manufacturing, advancement in data centers, increased uptake of electric vehicles, and various initiatives aimed at phasing out fossil fuel usage.

The rapid advancement in artificial intelligence has dramatically increased predictions for energy consumption, with technology firms pouring billions of dollars into resource-intensive data centers. These facilities can use as much electricity as medium-sized urban areas, leading power and utility providers to urgently seek solutions to cater to this new demand. Although certain utilities have started relying more heavily on natural gas in their plans, they remain convinced that renewable alternatives will ultimately be essential to satisfy these needs.

In the meantime, technology corporations have committed to maintaining their focus on renewable energy. Every major tech company has promised significant reductions in their carbon footprint over the next few years. They plan to achieve this partly through collaborations with electricity providers to accelerate the establishment of wind and solar facilities as well as other sources of green energy.

We’re continuing to witness numerous new installations of clean energy sources becoming operational, and we firmly anticipate this trend to persist,” states David Grumhaus, who serves as both the president and chief investment officer at Duff & Phelps Investment Management. “This financial commitment certainly won’t cease.

4. The uptake of electric vehicles encounters obstacles

The Trump administration at the beginning of this year

halted federal funding

To expand the country’s infrastructure for electric vehicle charging stations, the administration temporarily halted the approval of state proposals aimed at utilizing approximately $5 billion in grant funds to install rapid-charging points near highway exit areas. This pause was intended to ensure that motorists would gain greater confidence when traveling long distances, eliminating concerns over battery depletion.

Congress

had approved the funding

as part of the 2021 Infrastructure Investment and Jobs Act.

It’s anticipated that tariffs will increase the price of electric vehicles, which are currently pricier compared to those powered by gasoline. The country significantly depends on China for importing lithium-ion batteries utilized in EVs and for stabilizing the power grid with additional wind and solar initiatives. Consequently, numerous American car manufacturers have started scaling back their plans to introduce new electric vehicles.

“THE ELECTRIC VEHICLE MARKET IS EXTREMELY UNPREDICTABLE AND UNCERTAIN,” STATES VANESSA MILLER, A PARTNER AT FOLEY & LARDNER LLP SPECIALIZING IN LITIGATION AND LEADING THE FIRMS NATIONAL AUTOMOTIVE GROUP. “WE ARE WORKING TO PROTECT JOBS IN THE UNITED STATES; HOWEVER, WE WILL ALSO MAKE THESE VEHICLES SO EXPENSIVE THAT THEY BECOME OUT OF REACH FOR MANY CONSUMERS.”

5. The repeal of regulations under Trump might lead to fewer power plant closures.

U.S. coal-powered electricity facilities have been

under siege for years

As wind and solar installations, along with natural gas facilities, turned into more affordable options for generating electricity, many coal-powered plants have shut down recently. According to the Energy Information Administration, utility firms and energy providers intend to close down 8.1 gigawatts of coal-fired capability this year, which represents 4.7% of the entire U.S. coal infrastructure.

Last year, the Biden administration introduced regulations mandating coal plant operators to substantially decrease emissions and contaminants using carbon capture and similar technologies. This year, the Environmental Protection Agency announced plans to revisit some elements of these rules and set up an email address for businesses looking to obtain specific waivers.

This month, Trump issued an executive order aimed at bolstering support for the U.S. coal sector. The move partly involves removing some obstacles to both mining and utilizing coal for electricity production.

Although Trump’s modifications aren’t anticipated to result in the construction of additional coal-fired power plants, they could potentially delay plant shutdowns. According to a study conducted by the Rhodium Group, reversing the regulations implemented during the Biden administration, along with repealing the Inflation Reduction Act, might have this effect.

could reduce coal-plant retirements by over half by 2035

.

The most significant leverage comes from simply stating, ‘Actually, compliance with these regulations isn’t necessary,’ ” explains Ben King, one of the study’s authors. “Another approach is to increase the cost of alternatives to coal, which is where the tax incentives under the Inflation Reduction Act play a role here.

Katherine Blunt

She is a Wall Street Journal reporter covering renewable energy and utilities based in San Francisco. You can email her at

[email protected]

.