Tax Day is here, bringing positive news for individuals anticipating a refund—especially those who qualify for tax credits.

installing solar panels

. As the refund season has begun, specialists advise

breaking down

how these sizable government incentives work and how much they could save you.

The scoop

In a recent

Instagram video

, the solar specialists at

EnergySage

outlined how precisely federal government incentives for clean energy operate. The federal

Tax incentive for adopting solar energy

covers 30% of the total expense associated with transitioning to clean energy.

“This encompasses materials, labor, permits, and every other fee,” he stated.

EnergySage

spokesperson said in the

video

.

When filing your taxes for the year you had the solar panels installed, you can claim this tax credit. It will reduce your total tax bill, thereby decreasing the amount of taxes you end up owing.

Should you have paid sufficient taxes during the year, you might get a refund equivalent to the tax credit amount. Conversely, if you still owe money on your taxes, this credit will decrease what you owe. Any unused portion of the complete 30% credit can be rolled over into the subsequent year.

How it’s helping

Solar power is one of the least polluting energy options available to homeowners,

reducing reliance on the grid

, which is primarily driven by

dirty energy

Sources indicate. However, transitioning can come with significant costs.

EnergySage

estimates that the typical expense for setting up

solar panels

is around $29,000.

Watch Now: Just how harmful is a gas stove for your home’s indoor air quality?

That’s where

Inflation Reduction Act

Incentives become relevant. Once you apply the 30% federal tax credit from EnergySage,

says

The typical expense for setting up a system decreases to around $20,500 — and this figure doesn’t include any extra rebates from state programs or utilities.

Following the application of the tax credit, it approximately takes around

seven years

To recoup the funds spent on installing solar panels, after which the power generated becomes essentially cost-free.

In addition to explaining the complex legislation through videos,

EnergySage

Can also assist you with claiming this tax credit along with rebates.

free online resource

swiftly and effortlessly calculates your possible solar savings and assists you in comparing offers to secure the most advantageous deal.

What everyone’s saying

Countless homeowners

have

benefited

from

going solar

, with numerous individuals utilizing the credit to assist with covering the expenses.

|

|

One homeowner noted that the tax credits significantly improve the overall deal.

said

.

While you can

save money

By adopting solar power, the outlook for clean energy tax incentives and rebates remains unclear. President Donald Trump has

proposed

dismantling the

IRA

This might lead to a reduction or complete removal of governmental encouragement for environmentally friendly residential improvements, such as installing solar panels. Even though major alterations to the Inflation Reduction Act would necessitate congressional action, the initiative’s longevity is uncertain. Considering this ambiguity, utilizing the current IRA incentives could help you save thousands of dollars.

As EnergySage

advises

Make sure you don’t miss these savings.

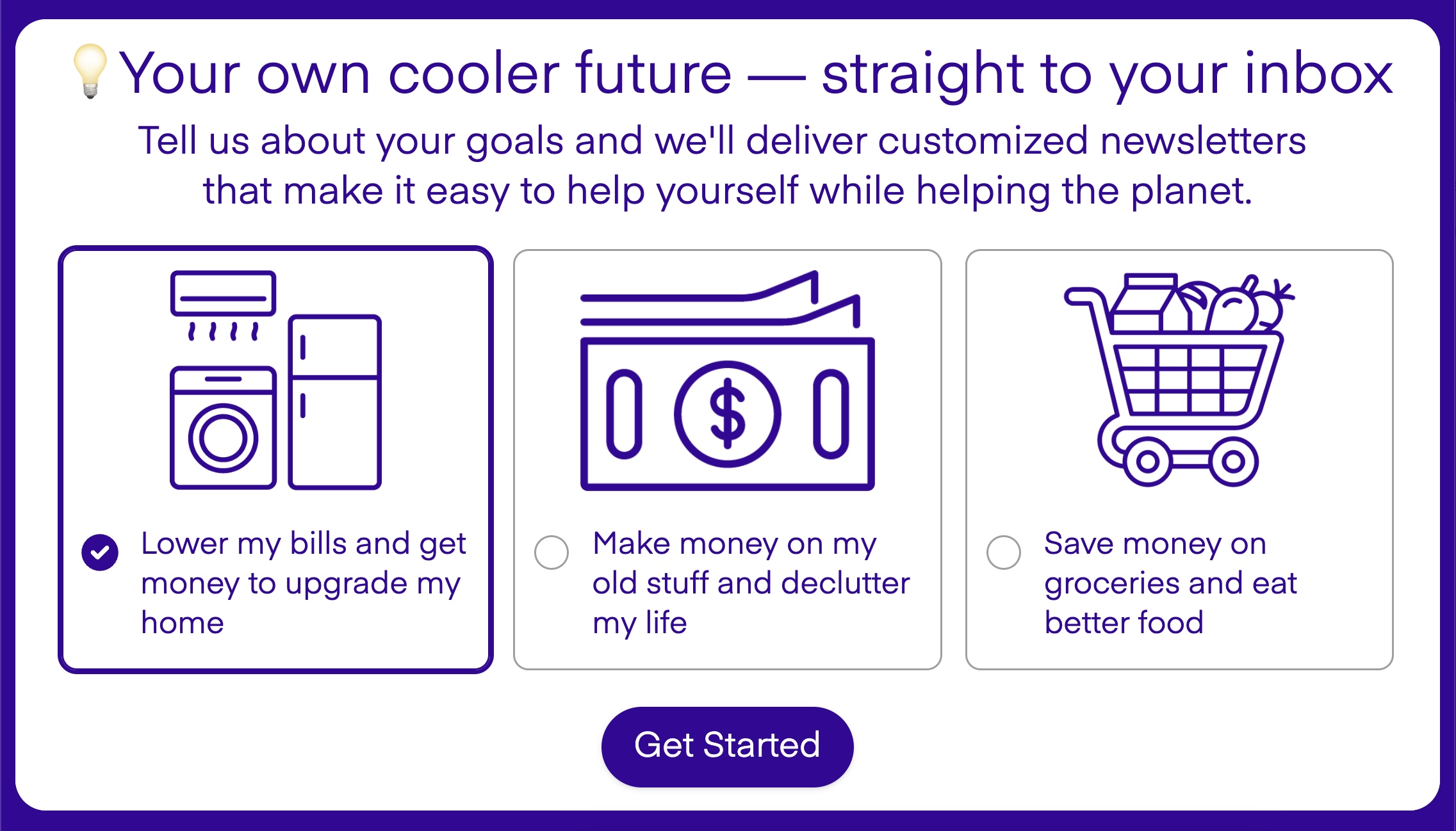

Join our

free newsletter

for easy tips to

save more

and

waste less

, and don’t miss

this cool list

Here are some simple methods to assist both yourself and the Earth.

These significant governmental incentives provide thousands of dollars for installing new solar panels: ‘Seize the opportunity to save money.’

first appeared on

The Cool Down

.