The three biggest asset management firms globally—BlackRock, Vanguard, and State Street—are opposing a lawsuit initiated by Texas along with several other GOP-controlled states. These states allege that these financial giants colluded to decrease coal output via concerted environmental advocacy efforts.

The asset managers

asked

The judge dismissed the lawsuit, stating: “Concluding that the plaintiffs have presented an antitrust claim based on these purported facts would necessitate twisting the legal framework in a manner that could harm both coal firms and individual investors.”

What’s happening?

In November 2024, Texas Attorney General Ken Paxton along with officials from ten additional states filed an antitrust lawsuit against three major asset management firms: BlackRock, Vanguard, and State Street.

The lawsuit claims that these companies leveraged their stock holdings and participation in climate-oriented groups to exert influence over coal businesses, compelling them to reduce output.

According to Reuters

The fund managers stated that the case provided no instances to back up their assertions. The motion

stated

There is absolutely no evidence suggesting that even one defendant was pressuring the coal companies to decrease production, let alone that all of them were collaborating on this effort.

What makes this movement significant?

The three companies oversee more than

$26 trillion in assets

They exert considerable power via proxy votes, influencing board elections and crafting Corporate Environmental, Social, and Governance strategies within the U.S. This legal action marks their initial substantial antitrust challenge concerning their ESG efforts.

Stream now: Just how harmful is a gas stove for your home’s interior air quality?

Some critics contend that investment approaches centered on climate issues could adversely affect conventional energy providers, potentially resulting in increased expenses for consumers. On the flip side, advocates maintain that basing investment choices on environmental considerations is crucial for maintaining Earth’s livability.

If the judge rejects the companies’ motion, multiple adverse outcomes might occur. This could impact ESG investment strategies and heighten regulatory ambiguity. Additionally, it could establish a harmful example for subsequent legal battles and weaken commitments to environmental stewardship.

business

.

What actions are being taken regarding this issue?

The initial judicial action for assessing the validity of a lawsuit is filing a motion to dismiss. Should the judge approve this request, the case will be discarded and won’t move forward to trial. Such an outcome would enable the companies to pursue their environmental, social, and governance (ESG) strategies without being hindered by the current accusations.

In the meantime, people can express their views to legislators and advocate for eco-friendly measures. For those looking to adopt climate-conscious actions at home, think about updating to

energy-efficient appliances

, installing

solar panels

, or opting for your next vehicle as

EV

.

|

|

Join our

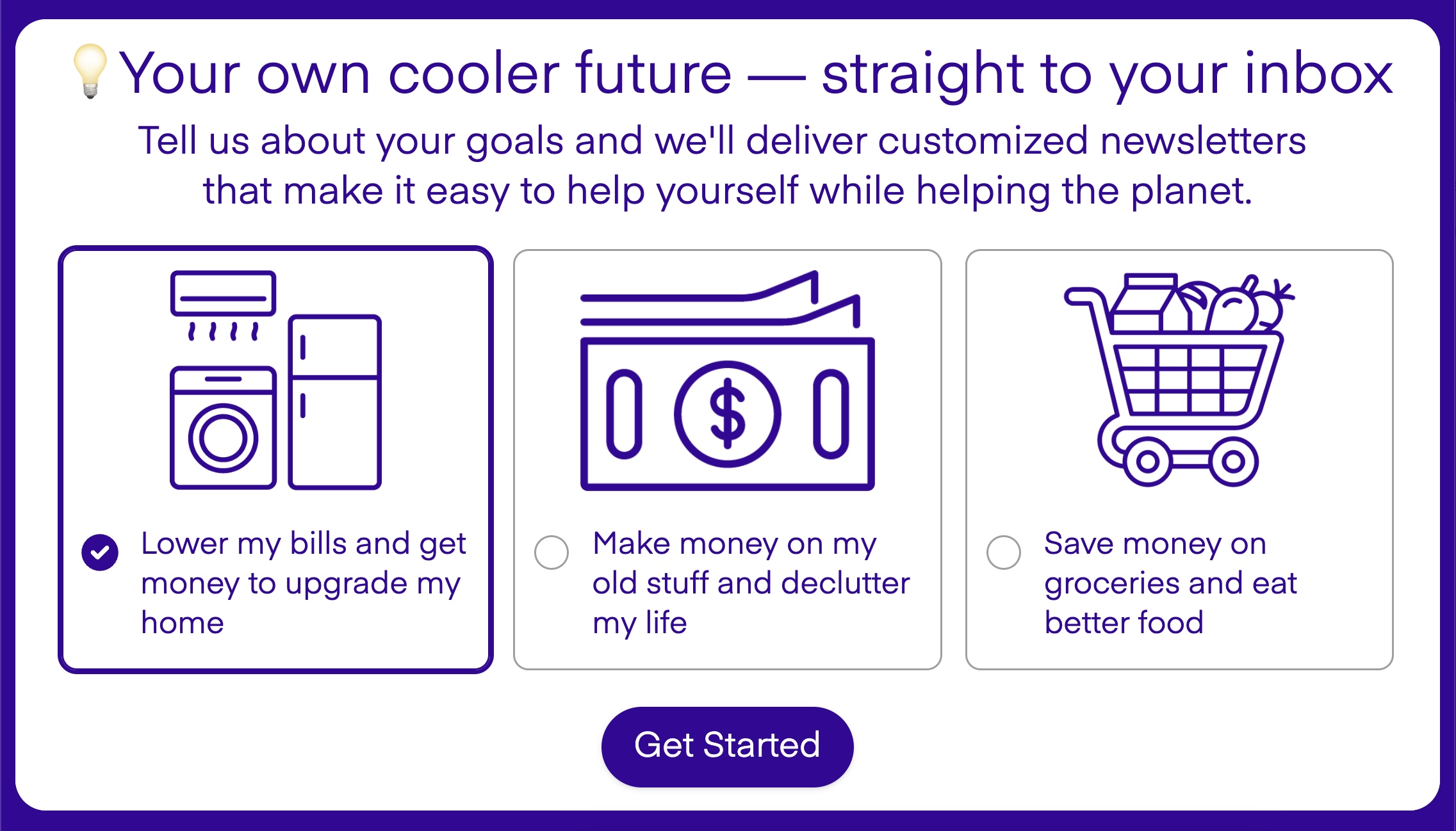

free newsletter

for

good news

and

useful tips

, and don’t miss

this cool list

Here are some simple methods to aid both yourself and the Earth.

Three trillion-dollar companies push back against contentious litigation: ‘No evidence whatsoever’

first appeared on

The Cool Down

.