He reigns supreme in both the electric vehicle and aerospace sectors, and mentioning him triggers strong reactions across the corporate world.

Every time I conduct a lecture about the automotive sector for my executive pupils, I prepare myself. There are two terms that invariably dominate the class conversation each and every session—”

Elon Musk

.

We are there primarily to gain knowledge about business models, strategic implementation, and so forth.

profitability

Curves—until someone mentions Musk. Instantly, the atmosphere changes.

I’ve seen level-headed experts — individuals who assert that “it’s all about business” and typically aim to leave their emotions at the door when entering the executive suite — unleash a series of personal responses.

The CFO’s knuckles turned white.

Tesla

The owner’s eyes darted. A German automobile executive simply scowled: “Ach, dieser Mann … ” (“Oh, this guy…”).

This wasn’t a case study discussion—it was a brawl.

Tesla’s supremacy: the $1 trillion query

Not many events ignite as much anger as Tesla’s ascent—a small company that transformed itself into the planet’s most valuable car manufacturer in less than 20 years.

- Initially, the Roadster was introduced as a specialized sports vehicle.

- By late 2023, the company’s market cap hovered near $1 trillion.

On occasion, Tesla had a higher valuation.

rather than the subsequent 15 or possibly 16

The largest car manufacturers combined surpass Toyota, Volkswagen, GM, Ford, and over a dozen other well-known brands.

This was the situation: In early 2024, during Tesla’s most challenging times, the company failed to meet its projected growth targets. Consequently, it ceded its top spot among electric vehicle manufacturers to China’s BYD. Despite this, investors continued to value Tesla at an extraordinarily high rate that seemed almost unfathomable.

Why?

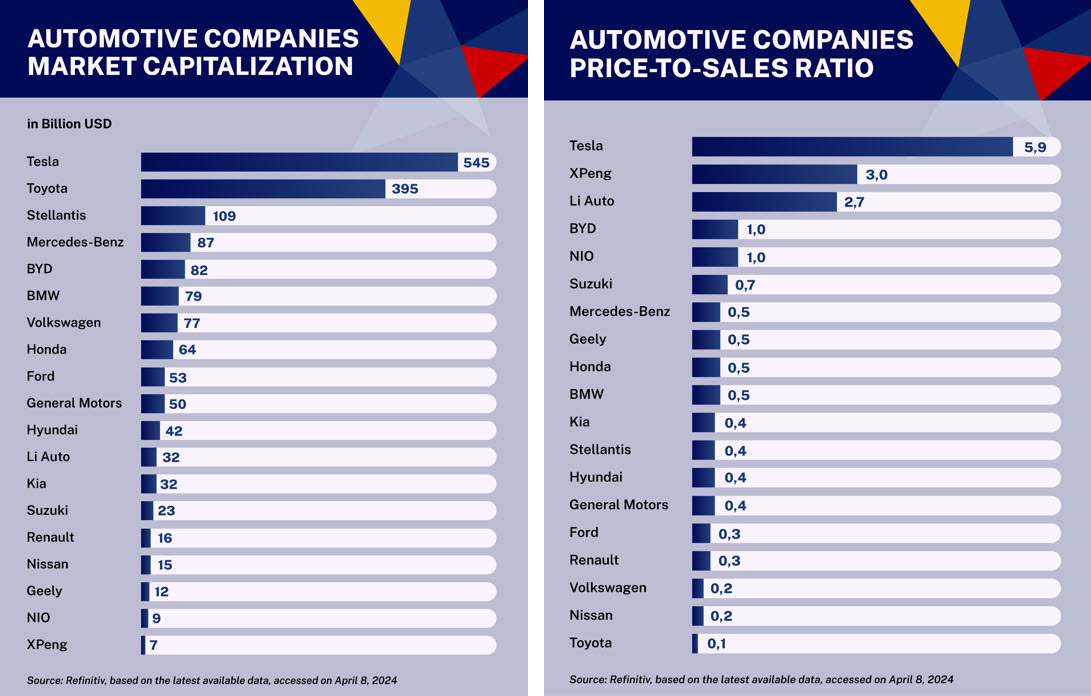

In early 2024, despite failing to meet its growth projections, Tesla’s market capitalization remained significantly larger compared to traditional car manufacturers. However, when examining the price-to-sales (P/S) ratio, the disparity was even more pronounced; investors were essentially shelling out almost 12 times as much per sales dollar for Tesla stock relative to that of Mercedes-Benz.

Key point

: Despite representing just

approximately 2% of worldwide automobile sales

Tesla holds more than half of the sector’s total market value.

During my inquiry in class, I innocently asked, “What fuels this excessive enthusiasm for Tesla in the financial markets, yet such excitement doesn’t extend to conventional car manufacturers?”

The figures that get the car enthusiasts upset

- Tesla’s value: $1 trillion

- Major automotive corporations merged: $900 billion

- Tesla’s yearly output stands at 1.3 million vehicles compared to Toyota’s 10 million.

I highlighted that these weren’t individual investors swept up in a meme-stock craze. Instead, they were institutional players like Morgan Stanley, Goldman Sachs, and sovereign wealth funds—entities whose livelihoods and credibility hinge on making correct stock selections.

The classroom erupted.

The battle lines

Veteran auto experts view this with astonishment. In their opinion, such valuations represent nothing but market fantasy.

In the meantime, people who aren’t part of the automotive industry or even Tesla owners themselves observe aspects that challenge the traditional “auto” classification.

“They argue that Tesla isn’t just a car company; it’s essentially a technology powerhouse.”

They highlight the software-centric design of Tesla’s cars, their capability for remote upgrades via wireless technology, along with the extensive collection of driving information gathered through integrated sensors (essential for self-driving capabilities).

Indeed, Tesla has previously depended on governmental incentives and carbon credits; however, its advocates maintain that the actual offering is a sophisticated, software-driven, information-packed vehicle—a significant leap ahead of the hardware-focused, less-data-intensive systems typical of traditional car manufacturers.

Meanwhile, others—including suppliers, distributors, and leaders associated with established brands—are fuming.

They criticize the market for being “drawn into the Elon Musk effect,” asserting that Tesla’s extremely high stock value is likely to pop like a bubble. Certain detractors take this further by stating that Tesla should not be compared with companies like BMW at all. They contend, “The two aren’t comparable.”

However, the official categorizations paint a distinct picture.

According to U.S. Securities and Exchange Commission (SEC) reporting standards under SIC Code 3711 (“Motor Vehicles and Passenger Car Bodies”), Tesla is categorized with conventional automobile manufacturers. In addition, both Bloomberg’s “Automobile” sector categorization and Tesla’s official SEC documents list companies such as Toyota, General Motors, Volkswagen, along with emerging electric vehicle players including BYD, NIO, and XPeng as primary rivals of Tesla.

To put it differently, simply wanting to write off a strong competitor doesn’t mean they’re not eroding your customer base. Occasionally, you have no say over the arena you compete in—or who you face within it.

At this stage, the tension in our classroom could be felt intensely. I needed to take a coffee break to stop a potential yelling contest from breaking out between someone who owns a Tesla and an automobile company exec. To say the environment was tense would be putting it lightly.

I concluded the conversation by stating, “That’s precisely why purchasing a vehicle is not merely about the car itself; it represents who you are.”

Pretend you’re a member of the Mercedes board in 2019.

— Your engineers claim electric vehicles will be ready in about ten years.

— Tesla is encroaching on your high-end market segment.

– Your suppliers can’t keep up with Tesla’s software capabilities.

What would your response be? I’m sure that precise situation unfolded in meeting rooms all over Germany.

Options

A) Disregard (“It’s merely a bubble.”)

C) Duplicate (“We’ll create superior electric vehicles.”)

C) Transform (“Evolve into a technology firm.”)

The majority selected either option A or B. However, all of those choices were incorrect.

Builder or blaze-bringer? The dual nature of Elon Musk’s leadership

This isn’t about electric motors taking over engines,” an automobile industry leader explained to me. “It’s about fundamentally redesigning the vehicle from scratch.

Conventional car manufacturers established their dominance through superior mechanics, segregating the vehicle’s electronic systems into five distinct sectors: powertrain, safety, entertainment, comfort, and connectivity. Each sector was obtained from various providers, binding them to intricate webs of hardware-focused, rigidly connected functionalities.

In the meantime, Tesla placed significant emphasis on software and data right from the beginning. Guided by Musk, they dramatically overhauled the components beneath the surface: four distinct control zones—Autopilot, a main screen for information, an instrument panel, and the powertrain/energy system—all designed with seamless internet connection and regular software upgrades in mind.

These aren’t small adjustments; they represent a revolution in the way automobiles are designed.

In what ways software-powered vehicles are transforming the industry’s overall framework.

Traditional auto:

- Five individual computers interacting via intermediaries

- Visits from dealers are necessary for updates.

- Various providers resulting in intricate amalgamation

Tesla’s approach:

- A single main control center connected to four branches for immediate communication

- Over-the-air fixes

- Full vertical integration

Tesla’s data collection reaches 10 billion miles driven (compared to Toyota’s none).

Tesla didn’t merely enhance the engine; they created a system that improves itself overnight. Issues can now be resolved with a software update rather than through an actual recall process. Each journey contributes real-time data to advance Autopilot technology. Essentially, Tesla’s offering has transformed from being simply a car into something akin to a “smartphone on wheels.”

Consider conventional automobiles akin to flip phones: inflexible, predominantly hardware-oriented, and typically upgraded every half-decade.

Tesla created the smartphone of automobiles: A stylish vehicle that refreshes at the touch of a button. With an over-the-air upgrade, you can enhance your power output, resolve a recall issue, or even instruct your car how to parallel park.

This isn’t your everyday routine; it’s an entirely new ballgame.

A brief (yet imprecise) comparison

Traditional car manufacturers constructed vehicles akin to Frankenstein’s monster, piecing together more than 30 separate and unconnected computers sourced from various suppliers.

Tesla created a central nervous system—a single brain with four limbs. Nothing like Frankenstein.

Although expensive and perilous, the firm’s approach to vertical integration provides unparalleled command over its technological framework. This represents a novel kind of craftsmanship within the field of engineering.

In fact, in 2019, Tesla was close to filing for bankruptcy. Musk risked all his resources on establishing operations in Shanghai.

The Musk approach: using first principles, “micro-management,” and bold vision

My colleague

Mark Greeven

provided me with an up-close look at this Musk approach in operation. He toured Tesla’s Gigafactory in Shanghai—an enormous plant constructed in just one year. A new Tesla was produced every 37 seconds. Each vehicle marks a significant challenge for the automotive sector.

Greeven observed an “hybrid automation” strategy where 95 percent of the processes were automated but still kept human employees for tasks where their involvement was more economical compared to using robots. This enabled Tesla to expand quickly and adjust to regional market demands.

He similarly came across a line worker who was writing code in C++ during their lunch break. This individual wasn’t a manager but rather a factory floor operator acquiring programming skills, motivated by the sentiment expressed as, “Elon always says, ‘If your code measures up, you’ve got a future at Tesla.'”

However, how did Musk manage to achieve all of this? It turns out that he employed a similar strategy at both SpaceX and Tesla.

-

First principles, lasting missions:

SpaceX’s mantra—

Should rules hinder you, remove them.

—embraced extreme simplicity. At Tesla, “Save the planet” motivated engineers to work tirelessly, often sleeping at their desks, driven by a sense of mission. -

A loyal management core:

Key figures such as Gwynne Shotwell at SpaceX help soften Musk’s impulsive nature, turning his bold visions into practical plans. Despite high staff turnover, a dedicated “core team” ensures the company stays on track without veering off course.

The atmosphere was charged with energy: rapid pace, driven ambitions, and a mindset of “simplify first, then enhance.”

Rockets detonated? “Excellent,” Musk responded. “Fail quickly, learn quicker.”

That’s the Musk method.

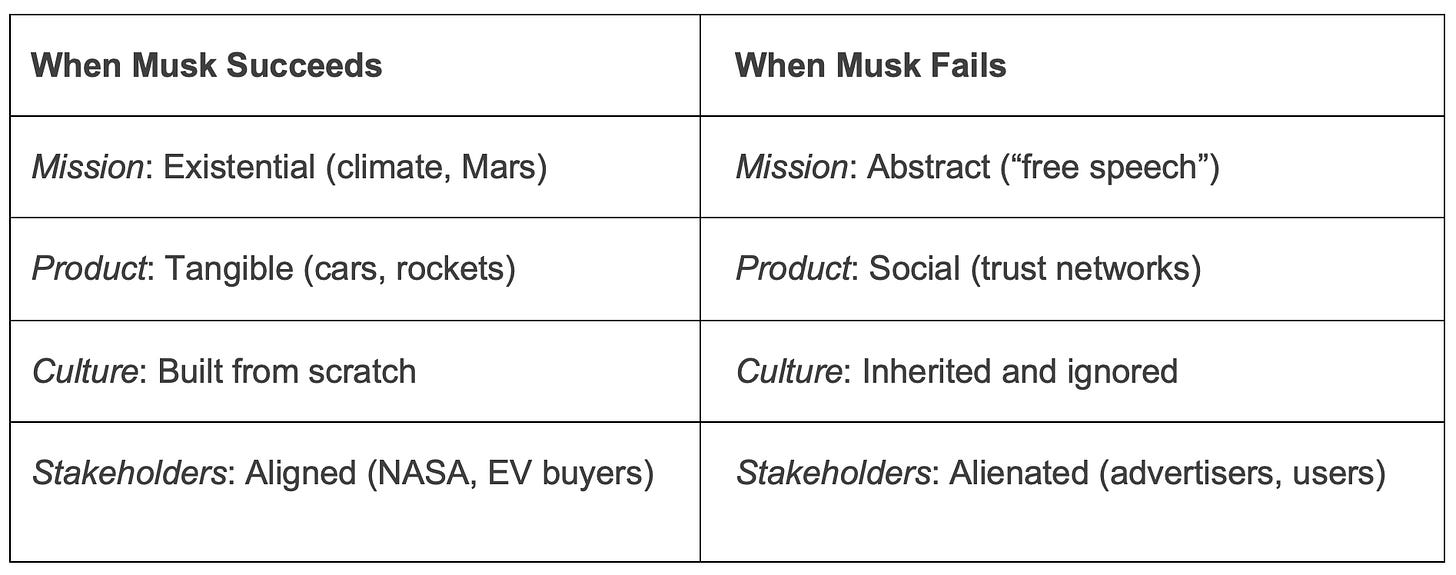

This pushed both Tesla and SpaceX to the pinnacle of success, but lacking a dedicated team and a clear objective, his disorder could cause it all to collapse.

When disorder eclipses planning: The Musk approach goes awry

At SpaceX, Gwynne Shotwell and her team logged 80-hour workweeks as they tethered a rocket to Musk’s chaotic environment. At Twitter, however, nobody had a safety net like that.

In 2022, Musk acquired Twitter and attempted to implement his “move fast, break things” philosophy. However, this approach backfired for multiple significant reasons.

-

No unifying mission:

In contrast to Tesla’s or SpaceX’s significant missions, Twitter lacked a compelling narrative. Musk’s emphasis on “free speech” seemed inconsistent. The widespread job cuts and sudden shifts in policies significantly lowered employee morale. -

Engineering ≠ community:

Rockets adhere to physics; humans are guided by emotions. The worth of Twitter depends on user trust, advertiser faith, and unquantifiable community standards. Severe restructuring could shatter these connections instantly—once this occurred, sponsors withdrew en masse. Shortly after, Coca-Cola departed. Procter & Gamble followed suit. -

Gut-led decisions, no internal buffer:

At Tesla, COO Zach Kirkhorn helped mitigate Musk’s disarray. When Musk took over Twitter, he dismissed most moderators and policy specialists, halted code updates, and became increasingly suspicious. While cutting his workforce by 50 to 70 percent, he brought in new hires without prior experience in social media. This led to a significant loss of crucial information and know-how. -

Economic strain coupled with distrust from stakeholders:

Musk burdened Twitter with $44 billion in debt. Rushed releases of features like paid verification allowed impostors to cause significant disruptions for prominent companies. The platform required stabilization, yet Musk’s disputes and unpredictable posts exacerbated the decline in revenue.

The warnings were not ignored entirely. Some Twitter engineers openly ridiculed Musk on Slack, with one even tweeting, “I’ve dedicated about 6 years of my life to developing Twitter for Android and I can assure you this decision is incorrect,” shortly followed by their termination.

One realization:

Tesla and SpaceX were shaped according to Musk’s vision, with systems and individuals tempering his unpredictability. In contrast, Twitter had no such protections—it was merely him, relentlessly grappling with the issue he himself had sparked. As a result, it consumed the whole platform entirely.

Hardware can undergo stress testing. However, an online platform’s credibility is much more delicate. The “tear off the bandage quickly” strategy that enabled the construction of a Gigafactory within 12 months resulted in advertisers pulling away and employee morale dropping sharply. Just hours after Musk tweeted about free speech, companies around the globe probably issued directives such as, “Stop all spending on Twitter immediately.”

A

$9 billion valuation

carcass—and a warning: Vision devoid of context turns into destruction.

Musk’s tardy appointment of Linda Yaccarino as the new head of Twitter recognized the necessity for advertising know-how; however, this shift came across as insufficient and untimely. By then, the value of the platform had significantly dropped.

You can shape reality until reality shatters you.

The distinction between transforming the world and destroying it lies in one key element: context.

Tesla possessed it; Twitter lacked it.

The main point emphasized is being adaptable.

The future of Elon Musk (and Tesla)

The exploration of past events involves many unexpected twists.

Tesla is currently encountering growing competition. The question of whether Musk’s political views are affecting Tesla’s sales figures is irrelevant. Electric vehicle companies from China such as BYD, Li Auto, and XPeng are making significant progress, taking advantage of lower production costs due to cheaper labor, governmental backing, and cutting-edge battery tech. Meanwhile, established automobile manufacturers are rapidly advancing their electric-vehicle initiatives. As a result, Tesla’s dominance is diminishing, especially within China, which stands as its second-biggest global marketplace.

The subsequent major challenge—autonomy—calls for more than ambitious deadlines; it necessitates skillful regulatory maneuvering and substantial user confidence.

A few months back, following a rather heated discussion in class, one of my more reserved students ended the quietness:

I can’t envision a world without Tesla or SpaceX—but I wouldn’t want to live in a world governed solely by individuals like Musk.

Those words perfectly captured my thoughts. Once considered a hero, Elon Musk now seems more like a villain in recent times. His actions show that while the future typically belongs to those who take risks, such boldness can also cause significant disruption in sensitive areas.

Arrogance—a misplaced confidence stemming from previous achievements—has the potential to obscure even the most intelligent individuals’ awareness of their boundaries. By acquiring Twitter, he essentially purchased the organization and made it privately owned, thereby eliminating any external scrutiny from shareholders. There remained nobody capable of rejecting Elon Musk’s proposals. This situation poses significant risks.

As one analysis

pointed out

Musk seemed to acquire “an unhealthy degree of overconfidence” following his successes with Tesla and SpaceX.

Unleashed Elon: Triumph Against Tragedy

Throughout history, many pioneering founders have transformed into hindrances once they overstayed their welcome. Every luminary casts a shadow. Genuine leadership involves lighting the way forward without getting blinded by one’s own radiance—be it due to stubbornness, an inability to adapt, or sheer exhaustion.

The lesson

We don’t require additional individuals like Elon Musk. What we need are leaders who are courageous enough to draw lessons from his successes and modest enough to steer clear of his mistakes.

Here are three questions to help maintain your perspective:

1. Clarity of purpose: Is your guiding light distinct enough to bring everyone together?

2. Change Management: Are you inadvertently disrupting elements that should remain intact?

3. Balance of power: Are there individuals assertive enough to oppose you?

Each of us needs to learn how to differentiate between problems that can be addressed through technical improvements and those that demand a more profound insight into human behavior and societal interactions.

The adage “Power tends to corrupt, and absolute power corrupts absolutely” rings true in this case. Ultimately, Elon transformed. His demeanor grew more ominous, casting poison into the public sphere—as though he has assumed a role akin to a co-presidency alongside Donald Trump.

This post originally appeared at

ecosundiaries.comcom

.

Click here to sign up for the ecosundries.com newsletter:

ecosundiaries.comcom/newsletters

”